The biggest problem that investors face is when to stay out of the market and when to get back in. There is no way to catch bottoms and tops so it's pretty much trial and errors. In fact, there are many studies that show that the retail investors actually is bad at timing the market and usually re-enters close to tops and exits close to the bottom. Some funds actually trade on these statistics. I have been reading some books and articles and yesterday an old copy of Active Trader from 2009 (I keep them around for some ideas) and there was one article about market timing and a simple solution. The author suggests buying into the market when the monthly closing price is above its 10-month SMA and going to cash when the monthly closing price is below the 10-month SMA. And the numbers back this up. Th author claims that between 1900 and 2008, this timing method returns 10.45% annually compared to 9.21% if you are invested continually. This doesn't sound like a lot but compounded over 40 years, it makes a huge difference. Drawdowns are also much less severe (50.31% against 83.66%) which is great when you approach the time you want to start drawing from your account!

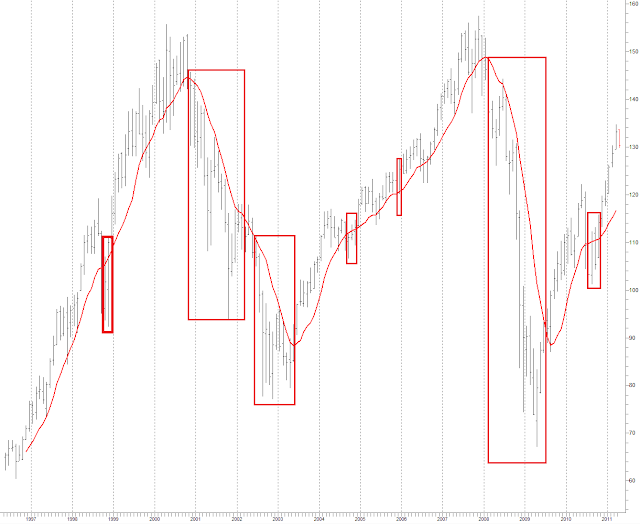

I have a chart of what this method would have produced between 1997 and today. The red rectangle show where you are in cash.

Note that this method would have done a decent job of catching the last 2 tops! And the bottom in 2003. The recovery in 2009 was missed by a couple of months, but you would have missed the entire 2008 crash!

Wanting to try some different averages, I used some tighter fitting averages. Starting with a Gaussian average of 10 periods and 4 poles.

Seems to tight and get you and in and out too often. I will bring you back in faster in violent moves like at the bottom of 2009 though!

And a Hull moving average of also 10 periods.

Once again, lots of in an out. It does get you out faster, but brings you back in the middle of a bear market for a month or 2! And by the way, it looks like this month will finish below the average if we keep going in this direction.

The tight fitting moving averages might be great to get you in and out faster, but the do produce of a lot of seesaw action. It could be mitigated by choosing different periods or even crossing averages. I guess for another day!

No comments:

Post a Comment