Large move with low volume are less meaningful. Today's move is another example. Look at the chart below. I charted SPY with a standard moving average and a volume weighted average. The standard average points up after today, but the volume weighted average stays flat! So not a convincing move...

And the DIA is even worse... The volume weighted average points down!

Wednesday, March 30, 2011

Resistance for OIH...

Here is a daily Fibonacci chart for OIH. We hit the high for the years yesterday and it seems to provide a bit of resistance at the moment.

The $150 line did provide some good support early this month during the "Japanese" crisis! The next support line at $159 or so seems to be pretty strong as well.

The $150 line did provide some good support early this month during the "Japanese" crisis! The next support line at $159 or so seems to be pretty strong as well.

An update on the weekly index charts

Here are some updated weekly charts to track the progress of our indices. All of them have bounced of the first Fibonacci line and the DIA and IWM are not making new highs for the year. SPY and QQQ are lagging!

DIA

IWM

SPY

QQQ

Monday, March 28, 2011

Combination Screen - 3/25/2011 List

Big week last week! The portfolio was up 3.42% as compared to the 2.77% for the broader average. We are now back close to 10% for the last 8 weeks, beating the market by more than 4-1. Stocks are up over 5% after I pick them with a holding period of about 4 weeks - there was just one survivor from the first group.

This is the last week for this group of stocks as I will rebalance the portfolio this week.

Here are the candidates for to be added next week:

As usual, I will pick only the top 10 of this list. There will be at least 1 survivor (ING) and 2 returning stocks (IM and SCSC).

This is the last week for this group of stocks as I will rebalance the portfolio this week.

Here are the candidates for to be added next week:

As usual, I will pick only the top 10 of this list. There will be at least 1 survivor (ING) and 2 returning stocks (IM and SCSC).

Saturday, March 26, 2011

Stock Valuation 3-26-2011

Being satisfied with the results of my combination screen so far, I wanted to use my criteria to calculate a valuation for many stocks to see at what price my screen would pick them up. I calculated 3 valuation based on my 3 main criteria:

Price/Sales - I want a valuation at less than 1.5 times Price/Sales. To arrive at a valuation, I multiply the revenues per share by 1.5.

Price/Book - I want to keep that criteria under 2. For this one, I multiply the book value per share by 2.

PEG - I choose stocks with a PEG under 1.5. My valuation is calculated by multiplying the long term projected growth (in percent) by the earning per share times 1.5.

In addition, I calculated an average of all 3 valuations just for fun!

I added a column to indicate if the stock was cheap or expensive relative to all criteria and the average. I published a table online that contains the valuation for over 1600 stocks. I'll try to expend it to more later. It can be viewed at this link.

Here are some sample valuations for popular and "momentum" stocks:

Not surprisingly enough, tech stock are usually expensive relative to book and sales, but cheap relative to PEG. With a PEG of 1.5 as a limit, I am overtly generous to growth. But keep in mind that the most important factor in my screen is Price to sales. And in this department, tech and "momentum" stocks fail badly! In this current list, the only stock matching the stock valuation criteria would be BAC, GE, GM, SPWRA and VZ. The last criteria in my screen is that the stock be within 95% of it's 52 week high which these stocks fail. But on a valuation basis, they might be worth a look!

Price/Sales - I want a valuation at less than 1.5 times Price/Sales. To arrive at a valuation, I multiply the revenues per share by 1.5.

Price/Book - I want to keep that criteria under 2. For this one, I multiply the book value per share by 2.

PEG - I choose stocks with a PEG under 1.5. My valuation is calculated by multiplying the long term projected growth (in percent) by the earning per share times 1.5.

In addition, I calculated an average of all 3 valuations just for fun!

I added a column to indicate if the stock was cheap or expensive relative to all criteria and the average. I published a table online that contains the valuation for over 1600 stocks. I'll try to expend it to more later. It can be viewed at this link.

Here are some sample valuations for popular and "momentum" stocks:

Not surprisingly enough, tech stock are usually expensive relative to book and sales, but cheap relative to PEG. With a PEG of 1.5 as a limit, I am overtly generous to growth. But keep in mind that the most important factor in my screen is Price to sales. And in this department, tech and "momentum" stocks fail badly! In this current list, the only stock matching the stock valuation criteria would be BAC, GE, GM, SPWRA and VZ. The last criteria in my screen is that the stock be within 95% of it's 52 week high which these stocks fail. But on a valuation basis, they might be worth a look!

Thursday, March 24, 2011

Bouncing off our levels

Here are some updated charts for the major indices. They show that we successfully bounced off our first Fibonacci line of support following the "Japan" selloff! QQQQ is definitely the laggard here. It is well below the 50 day MA. SPY will have to hit against it today. Something to keep in mind!

DIA

SPY

QQQ

IWM

Wednesday, March 23, 2011

Combination Screen - 3/18/2011 Results

Here at last the results from last week! Sorry it's late, I have been buy with other projects! I'll publish only the results for the running portfolio this week and resume full fledge results next week!

For the second time in 7 weeks, the portfolio trailed the broader average last week - only by 0.2%. Overall, the portfolio is up over 6% since inception while the S&P500 just turned negative in the last week. Not bad! This is the last week for this set of stocks as I will rebalance next week after 4 weeks.

For the second time in 7 weeks, the portfolio trailed the broader average last week - only by 0.2%. Overall, the portfolio is up over 6% since inception while the S&P500 just turned negative in the last week. Not bad! This is the last week for this set of stocks as I will rebalance next week after 4 weeks.

Wednesday, March 16, 2011

Tuesday, March 15, 2011

Dive, dive.....

Here is a set of updated weekly charts following this morning sell off. We are at important levels now - Fibonacci and regression channel.

DIA

SPY

QQQQ

IWM

Saturday, March 12, 2011

Combination Screen - 3/12/2011 List

And here is the list for this week! As usual, sorted in ascending Price-to-Sales. The top 10 that I will track are hilighted in yellow.

Combination Screen - 3/11/2011 Results

A loss last week in the main portfolio, but we averted disaster as the portfolio lost 0.12% compared to -1.23% for the S&P500. Over the last 6 weeks, the portfolio is up 8.95% compared to 1.86% for the broader index. I say this qualify as pretty good! But the last 2 weeks have been challenging and might be a warning for things to come. Here are the numbers:

Still only 3 losers overall out of 19 picks. The stocks are still up 4.71% after I put them in the portfolio on average. In 2 more weeks I'll re-balance again which seems to be the only way to stay ahead of this market! There seems to be some luck involved as well, but we'll take what we can.

Here is an update of the other lists as well.

1/31/2011 List

This was the original list that I am still maintaining to get long term results out of the screen. It didn't have a great week last week as the list lost 2.37%, almost double the market average. Over the last 6 weeks, it is still ahead of the index though.

2/14/2011 List

Another list that has a bad week! But overall, it is still ahead of the market. This list and the next one were started at the top to the market so they reflect results in a more challenging environment. Another good test.

As this list is 4 weeks old, I should think of re-balancing it with new blood!

2/21/2011 List

This list kept up somewhat with the average last week, but is still doing better over the last 3 weeks. It was started around the top of the market and the S&P500 is down 2.74% over these last 3 weeks. The overall list is down only 1.57%. It is help by one big winner in PC Mall though, but if the screen can pick out winners like that, why not use it!

This is it for this week. The original list is doing great and only one portfolio (excluding the one week old one) is doing worse than the overall market. I don't want to draw any conclusion, but it is promising so far.

I should think of some hedging method to boost returns when the market goes down. Something for next week's post.

Still only 3 losers overall out of 19 picks. The stocks are still up 4.71% after I put them in the portfolio on average. In 2 more weeks I'll re-balance again which seems to be the only way to stay ahead of this market! There seems to be some luck involved as well, but we'll take what we can.

Here is an update of the other lists as well.

1/31/2011 List

This was the original list that I am still maintaining to get long term results out of the screen. It didn't have a great week last week as the list lost 2.37%, almost double the market average. Over the last 6 weeks, it is still ahead of the index though.

2/7/2011 List

This list is not really doing well as it is dragged down by 2 big losers! But it's the reason why we want to test this screen over a long period of time and starting at different times. There will be bad times and good time! As long as the good results outweigh the bad ones, we'll be set. Also, we are not implementing any type of stop loss. Ideally, I should re-balance this list to see if it has any kind of impact as this list is now 5 weeks old!

Another list that has a bad week! But overall, it is still ahead of the market. This list and the next one were started at the top to the market so they reflect results in a more challenging environment. Another good test.

As this list is 4 weeks old, I should think of re-balancing it with new blood!

2/21/2011 List

This list kept up somewhat with the average last week, but is still doing better over the last 3 weeks. It was started around the top of the market and the S&P500 is down 2.74% over these last 3 weeks. The overall list is down only 1.57%. It is help by one big winner in PC Mall though, but if the screen can pick out winners like that, why not use it!

2/28/2011 List

This list is a big winner. The market is down 1% and the list is up 2.90%. Maybe some luck...

3/7/2011 List

Last week list... This one is down close to 0.5% compared to the broader average. But still did better than the 5 week old list which would lead me to think that re-balancing after 4 weeks is the way to go.

I should think of some hedging method to boost returns when the market goes down. Something for next week's post.

Thursday, March 10, 2011

When to go to cash?

The biggest problem that investors face is when to stay out of the market and when to get back in. There is no way to catch bottoms and tops so it's pretty much trial and errors. In fact, there are many studies that show that the retail investors actually is bad at timing the market and usually re-enters close to tops and exits close to the bottom. Some funds actually trade on these statistics. I have been reading some books and articles and yesterday an old copy of Active Trader from 2009 (I keep them around for some ideas) and there was one article about market timing and a simple solution. The author suggests buying into the market when the monthly closing price is above its 10-month SMA and going to cash when the monthly closing price is below the 10-month SMA. And the numbers back this up. Th author claims that between 1900 and 2008, this timing method returns 10.45% annually compared to 9.21% if you are invested continually. This doesn't sound like a lot but compounded over 40 years, it makes a huge difference. Drawdowns are also much less severe (50.31% against 83.66%) which is great when you approach the time you want to start drawing from your account!

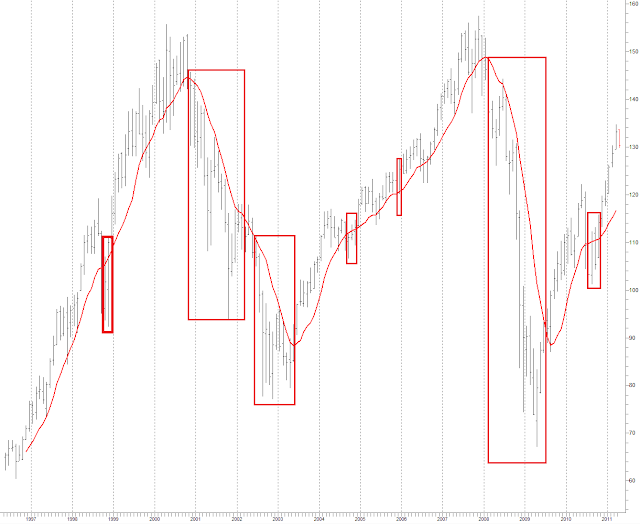

I have a chart of what this method would have produced between 1997 and today. The red rectangle show where you are in cash.

Note that this method would have done a decent job of catching the last 2 tops! And the bottom in 2003. The recovery in 2009 was missed by a couple of months, but you would have missed the entire 2008 crash!

Wanting to try some different averages, I used some tighter fitting averages. Starting with a Gaussian average of 10 periods and 4 poles.

Seems to tight and get you and in and out too often. I will bring you back in faster in violent moves like at the bottom of 2009 though!

And a Hull moving average of also 10 periods.

Once again, lots of in an out. It does get you out faster, but brings you back in the middle of a bear market for a month or 2! And by the way, it looks like this month will finish below the average if we keep going in this direction.

The tight fitting moving averages might be great to get you in and out faster, but the do produce of a lot of seesaw action. It could be mitigated by choosing different periods or even crossing averages. I guess for another day!

I have a chart of what this method would have produced between 1997 and today. The red rectangle show where you are in cash.

Note that this method would have done a decent job of catching the last 2 tops! And the bottom in 2003. The recovery in 2009 was missed by a couple of months, but you would have missed the entire 2008 crash!

Wanting to try some different averages, I used some tighter fitting averages. Starting with a Gaussian average of 10 periods and 4 poles.

Seems to tight and get you and in and out too often. I will bring you back in faster in violent moves like at the bottom of 2009 though!

And a Hull moving average of also 10 periods.

Once again, lots of in an out. It does get you out faster, but brings you back in the middle of a bear market for a month or 2! And by the way, it looks like this month will finish below the average if we keep going in this direction.

The tight fitting moving averages might be great to get you in and out faster, but the do produce of a lot of seesaw action. It could be mitigated by choosing different periods or even crossing averages. I guess for another day!

Mid-Day Charts with PP and S/R - 3-10-2011

Here are the lines mid-day today! No sense showing resistance lines! Bad day overall.... Some of the indices are already below S3 - the 3 red line from the top.

AAPL

DIA

IWM

QQQQ

SPY

Oil - Support and Resistance 3/10/2011

Here are the support lines for oil this morning. No point showing resistance at this point since I doubt we'll get there. These lines are based on 24 hours trading not just the NYMEX hours. There is so much going on after hours that it's almost pointless to use these lines...

Dollar Today! Boosted....

Wheee... The dollar is on a roll! Approaching the 50% retracement line. No wonder the everything is going down today.

Wednesday, March 9, 2011

That was a good auction

An article in the FT blog was mentioning that today Treasury auction would be good... Indeed it was!

Mid-Day Charts with PP and S/R - 3-9-2011

Here are some mid-day charts for indices, AAPL and oil. Some lines are thick to indicate the disparity between pivot calculation. It's actually nice because it might also give an indication of the strength of the line. To be tested!

AAPL

DIA

IWM

/CL (Oil)

QQQQ

SPY

Subscribe to:

Comments (Atom)